It’s also a helpful metric to track how sales affect profits over time. In the same example, CMR per unit is $100-$40/$100, which is equal to 0.60 or 60%. So, 60% of your revenue is available to cover your fixed costs and contribute to profit. Regardless of how contribution margin what is a pay raise at work is expressed, it provides critical information for managers. Understanding how each product, good, or service contributes to the organization’s profitability allows managers to make decisions such as which product lines they should expand or which might be discontinued.

- Understanding the contribution margin of your products or services can guide critical decisions such as pricing, product mix, and cost management.

- This means that you can reduce your selling price to $12 and still cover your fixed and variable costs.

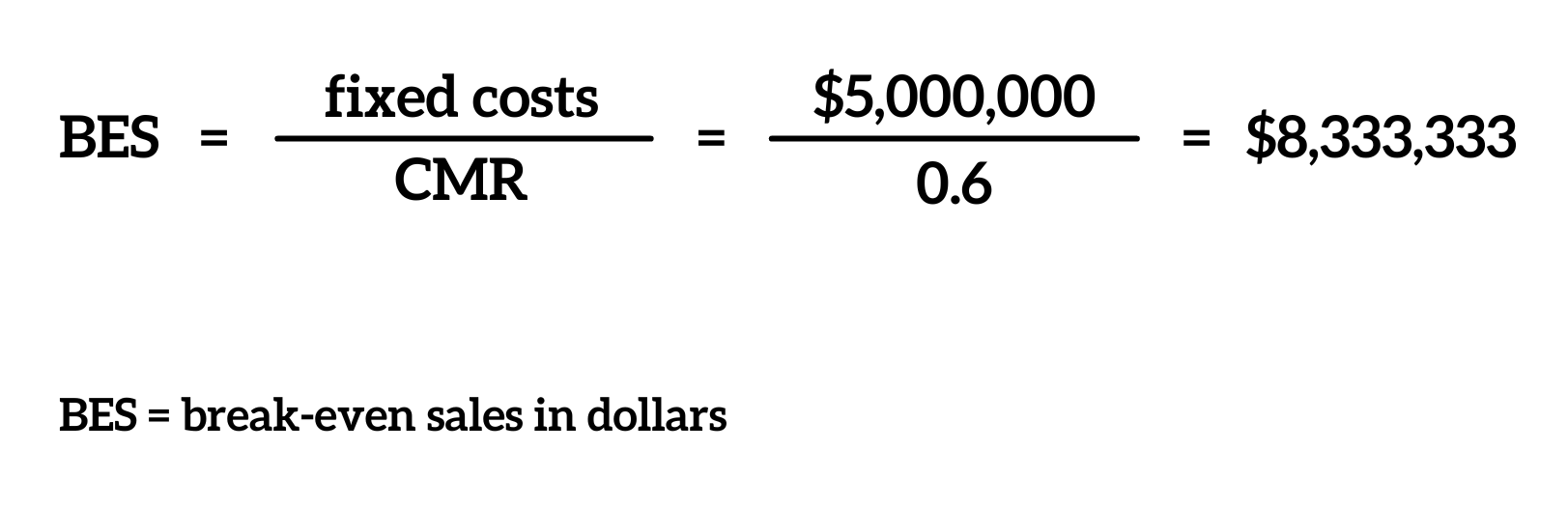

- This is because the breakeven point indicates whether your company can cover its fixed cost without any additional funding from outside financiers.

- The contribution margin is given as a currency, while the ratio is presented as a percentage.

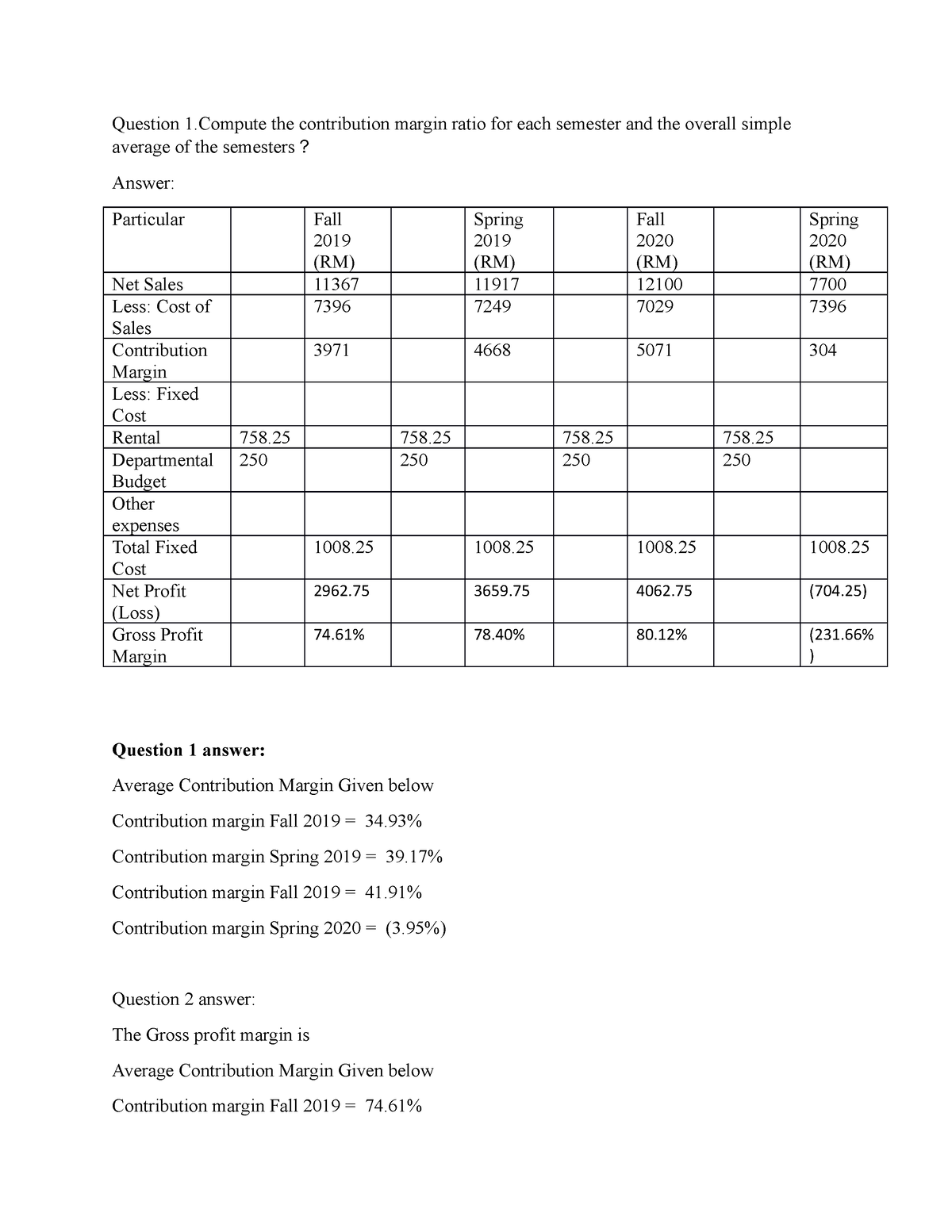

Income Statement

It is essential for understanding the profitability of individual products and making informed business decisions. The difference between fixed and variable costs has to do with their correlation to the production levels of a company. As we said earlier, variable costs have a direct relationship with production levels. As production levels increase, so do variable costs and vise versa. Thus, the level of production along with the contribution margin are essential factors in developing your business. Now, it is essential to divide the cost of manufacturing your products between fixed and variable costs.

Role in Pricing Strategies and Cost Control

In addition, although fixed costs are riskier because they exist regardless of the sales level, once those fixed costs are met, profits grow. All of these new trends result in changes in the composition of fixed and variable costs for a company and it is this composition that helps determine a company’s profit. For example, it can help a company determine whether savings in variable costs, such as reducing labor costs by using a new machine, justify the increase in fixed costs. This assessment ensures investments contribute positively to the company’s financial health. With a contribution margin of $200,000, the company is making enough money to cover its fixed costs of $160,000, with $40,000 left over in profit.

How is contribution margin calculated?

The result is the amount that contributes to covering the fixed costs and, subsequently, to the profit. If you need to estimate how much of your business’s revenues will be available to cover the fixed expenses after dealing with the variable costs, this calculator is the perfect tool for you. You can use it to learn how to calculate contribution margin, provided you know the selling price per unit, the variable cost per unit, and the number of units you produce. The calculator will not only calculate the margin itself but will also return the contribution margin ratio. As you will learn in future chapters, in order for businesses to remain profitable, it is important for managers to understand how to measure and manage fixed and variable costs for decision-making. In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making.

What is the contribution ratio formula?

Thus, \(20\%\) of each sales dollar represents the variable cost of the item and \(80\%\) of the sales dollar is margin. Just as each product or service has its own contribution margin on a per unit basis, each has a unique contribution margin ratio. The contribution margin ratio is just one of many important financial metrics used for making better informed business decisions.

That is, it refers to the additional money that your business generates after deducting the variable costs of manufacturing your products. The contribution margin helps to easily calculate the amount of revenues left over to cover fixed costs and earn profit. As mentioned earlier, the contribution margin ratio can help businesses determine the lowest possible price at which sales can be made and still break even.

Managerial accountants also use the contribution margin ratio to calculate break-even points in the break-even analysis. Management should also use different variations of the CM formula to analyze departments and product lines on a trending basis like the following. One common misconception pertains to the difference between the CM and the gross margin (GM). Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

As mentioned above, the contribution margin is nothing but the sales revenue minus total variable costs. Thus, the following structure of the contribution margin income statement will help you to understand the contribution margin formula. This demonstrates that, for every Cardinal model they sell, they will have \(\$60\) to contribute toward covering fixed costs and, if there is any left, toward profit.